Key Factors Driving CAGR Growth in 2025

In 2025, several key factors are expected to drive Compound Annual Growth Rate (CAGR) growth in various sectors. One significant driver is the rapid advancement in technology, particularly in areas such as artificial intelligence, cloud computing, and blockchain. Companies that leverage these technologies efficiently are likely to experience substantial CAGR growth as they improve operational efficiency, enhance customer experiences, and create innovative products and services to stay competitive in the market.

Another crucial factor propelling CAGR growth is the increasing demand for sustainable and environmentally friendly practices. In response to growing concerns about climate change and environmental degradation, companies across industries are shifting towards sustainable business models. Those that embrace sustainable practices not only contribute to a better future but also attract environmentally conscious consumers, leading to higher revenues and CAGR growth. Additionally, investors are showing a preference for companies with strong environmental, social, and governance (ESG) practices, further boosting CAGR growth for sustainable businesses.

Potential Risks to Consider Before Investing in High CAGR Stocks

Investing in high compound annual growth rate (CAGR) stocks can offer attractive returns, but it’s essential for investors to be mindful of the potential risks involved. One key risk to consider is the volatility often associated with high-growth stocks. These stocks tend to experience significant price swings, which can lead to short-term fluctuations in the value of your investment.

Additionally, high CAGR stocks are often more sensitive to changes in market conditions and investor sentiment. Any negative news or macroeconomic factors can quickly impact the stock price, potentially leading to sudden and substantial losses. It’s crucial for investors to conduct thorough research and have a clear risk management strategy in place before diving into high CAGR stocks.

CAGR CalculatorInvesting in high CAGR stocks can offer attractive returns, but it’s crucial to be aware of the potential risks involved. Volatility and sensitivity to market conditions can lead to significant price swings and sudden losses. Thorough research and risk management are essential before investing in high-growth stocks.

Top Technology Stocks Expected to Lead CAGR Growth

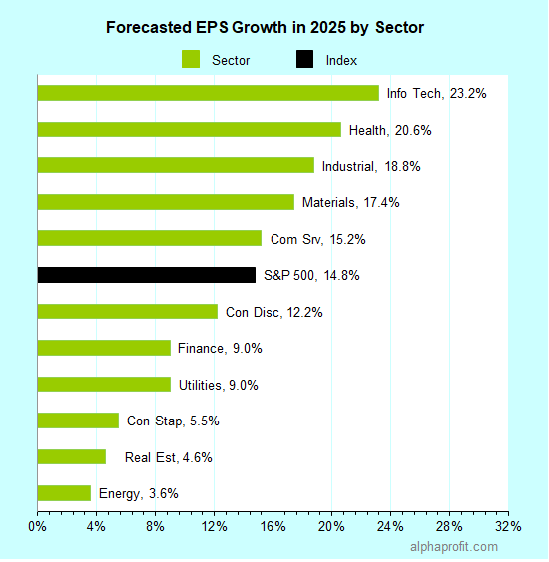

Technology stocks are anticipated to be at the forefront of driving CAGR growth in 2025. Companies that are innovating in areas such as artificial intelligence, cloud computing, and cybersecurity are expected to see substantial increases in their Compound Annual Growth Rates. With the increasing reliance on technology across industries and society, these stocks are well-positioned to capitalize on this trend and deliver strong returns to investors.

Investors looking for opportunities in the technology sector should focus on companies that are pioneering disruptive technologies and have a strong track record of consistent growth. Leaders in emerging tech fields, such as 5G connectivity, Internet of Things (IoT), and e-commerce platforms, are likely to drive significant CAGR growth in the coming years. By conducting thorough research and assessing the potential of these technology stocks, investors can position themselves to benefit from the rapid advancements in the digital landscape.

Healthcare Stocks Poised for Significant CAGR Growth

Investors focusing on the healthcare sector for potential growth opportunities in terms of compound annual growth rate (CAGR) might find promising prospects ahead. The industry’s resilience and adaptability to changing market dynamics, coupled with advancements in medical technology and treatments, position healthcare stocks for significant CAGR growth in the coming years. With increasing demand for innovative healthcare solutions and services globally, companies within this sector are well-positioned to capitalize on emerging trends and drive sustainable growth.

Moreover, the ongoing emphasis on healthcare infrastructure development, digitalization of healthcare services, and the rising prevalence of chronic diseases are key drivers expected to fuel the growth of healthcare stocks in terms of CAGR. As the population ages and the need for specialized medical care grows, healthcare companies that offer cutting-edge products and services stand to benefit from a more extensive market reach and increased revenue streams. By staying attuned to evolving consumer demands and regulatory changes, healthcare stocks have the potential to outperform other sectors and deliver long-term value to investors seeking growth opportunities.

Emerging Market Opportunities for CAGR Growth

In emerging markets, there is a palpable sense of dynamism and potential for growth that is attracting the attention of investors worldwide. These markets offer unique opportunities for companies to expand their reach and tap into previously untapped consumer bases. With increasing urbanization, rising disposable incomes, and a shift towards digitalization, emerging markets present a fertile ground for businesses looking to achieve high CAGR growth.

While the potential for growth in emerging markets is promising, it is essential for investors to tread cautiously. Factors such as political instability, currency fluctuations, and regulatory uncertainties can pose significant risks to investments in these markets. Conducting thorough market research, assessing local conditions, and diversifying portfolios can help mitigate these risks and make the most of the growth opportunities presented by emerging markets.

Retirement Calculator Emerging markets present unique opportunities for companies to achieve high CAGR growth. However, investors must be cautious of risks such as political instability and currency fluctuations. Thorough market research and diversification can help mitigate these risks and maximize growth potential.

Consumer Goods Companies with Promising CAGR Projections

Consumer goods companies are currently showing promising growth potential in terms of compound annual growth rate (CAGR). This sector encompasses a wide range of products that are in constant demand, from household essentials to luxury items. With changing consumer preferences and an increase in disposable income, consumer goods companies are strategically positioning themselves to capitalize on emerging trends and secure steady growth.

Investors looking for stable returns and long-term growth prospects may find consumer goods companies an attractive option. Brands that offer innovative products, superior quality, and effective marketing strategies have the potential to outperform market expectations and deliver robust CAGR figures. As global markets continue to evolve, consumer goods companies that adapt quickly to changing consumer needs and preferences are expected to maintain their competitive edge and drive strong CAGR growth in the foreseeable future.

Energy Sector Stocks to Watch for High CAGR Growth

As the global focus shifts towards renewable energy sources, traditional energy sector stocks continue to seek avenues for sustainable growth and innovation. Companies in the energy sector that are investing in renewable energy technologies, such as solar and wind power, are positioning themselves for potential high compound annual growth rates (CAGR). These forward-thinking approaches are attracting investors looking for long-term sustainable options in the energy market.

Moreover, the push for cleaner energy solutions is driving innovation and investment in energy storage technologies. Companies that are developing efficient battery storage solutions to mitigate the intermittent nature of renewable energy sources are likely to see strong CAGR growth prospects. As the energy sector evolves to meet the changing landscape of consumer demands and environmental regulations, these advancements in energy storage capabilities are poised to play a significant role in driving growth for energy sector stocks with a focus on sustainability.

Financial Services Stocks with Strong CAGR Potential

Financial services stocks have garnered considerable interest from investors seeking strong CAGR potential. These companies are well-positioned to benefit from a variety of factors, including a robust economy and low interest rates. Additionally, the increasing shift towards digital banking and fintech innovations are opening up new avenues for growth in the financial services sector.

Investors looking for stocks with strong CAGR potential in the financial services industry should keep an eye on companies that are effectively leveraging technology to enhance their services and improve operational efficiency. With the rise of online banking and mobile payment solutions, financial institutions that can adapt quickly to changing consumer preferences stand to experience substantial growth in the coming years. By focusing on companies with a strong track record of innovation and a clear growth strategy, investors can capitalize on the promising CAGR projections in the financial services sector.

Mutual Fund investors should focus on financial services stocks leveraging technology for growth. Companies embracing digital banking and fintech innovations are well-positioned for strong CAGR potential. Online banking and mobile payment solutions are driving growth in the financial services sector.

Industrial Sector Stocks Showing Positive CAGR Trends

The industrial sector is showing promising signs of positive CAGR trends in the coming years. Companies within this sector are leveraging technological advancements, operational efficiencies, and strategic growth initiatives to drive sustainable growth. With increasing demand for industrial goods and services globally, these stocks are well-positioned to capitalize on market opportunities and deliver robust performance.

Investors looking for opportunities in the industrial sector should pay close attention to companies that are focused on innovation and adapting to changing market dynamics. By identifying industry leaders with solid growth strategies and a track record of delivering results, investors can potentially benefit from the positive CAGR trends in this sector. As the global economy continues to recover and industries ramp up their production capacities, industrial sector stocks hold significant potential for long-term growth and value creation.

Trading App Industrial sector stocks are poised for positive CAGR trends, driven by technological advancements and strategic growth initiatives. Companies focusing on innovation and market adaptability stand to benefit from increasing global demand for industrial goods and services, offering potential for long-term growth and value creation.

Retail Industry Stocks with High CAGR Growth Prospects

Investors eyeing the retail industry for high CAGR growth prospects have identified key players that show promise in the coming years. Companies leveraging innovative e-commerce strategies, robust supply chain management, and customer-centric approaches are positioned to capitalize on the shifting consumer landscape. With the increasing demand for seamless shopping experiences and personalized offerings, retailers that can adapt swiftly to changing preferences are likely to outperform their competitors.

Moreover, as the retail sector continues to embrace digital transformation and omnichannel retailing, companies with a strong online presence and effective integration of digital technologies are expected to drive significant CAGR growth. By leveraging data analytics for targeted marketing, enhancing customer engagement, and optimizing operational efficiencies, retail stocks with a forward-looking approach are primed to capture market share and deliver strong returns to investors.